Blog

Tips Pay Betting Gains Taxation

Content

- Cybersecurity to possess Tax Analysis: Safeguarding Organization Painful and sensitive Suggestions

- Taxes to your Betting Payouts and you can Losses: 8 Tips to Think about

- Government Unemployment Income tax Management 101: FUTA Strategies for Companies

- Explain Investment Money and Projected Income tax Costs inside the 2025

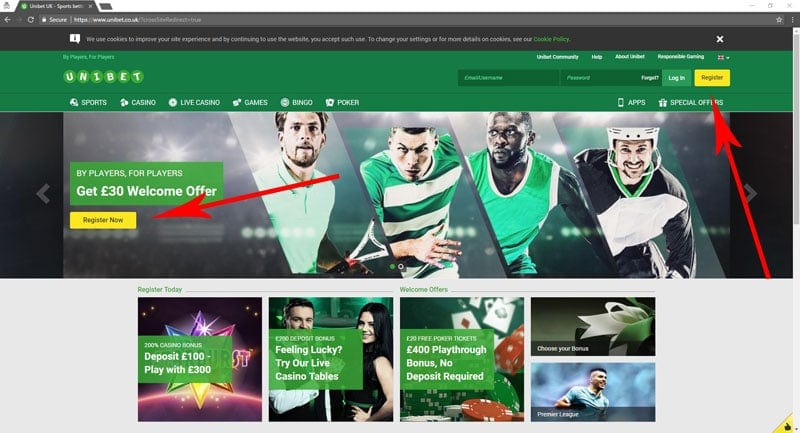

It’s 2025, and sports betting is a problem regarding the Joined Says. 38 says and https://amspmjpr.com/guong-1xbet-lam-viec-1xbet-loi-vao-trang-web-ca-nhan/ also the District out of Columbia provides legalized at least one type of gaming, possibly retail or on line. This is an excellent task, plus one that lots of might not have expected back in 2018, in the event the Supreme Court lifted the brand new federal prohibit to your sports betting. State taxes are very different to possess playing earnings; certain claims also have an apartment income tax speed to have playing when you are someone else may have more complicated regulations.

The Congressional Gaming Caucus is actually in the first place shaped regarding the 20th 100 years. It had been meant to be a car to possess gambling and you may local casino organizations to have its state to your Congressional points. Captain Deputy Whip Man Reschenthaler and you can Member Dina Titus will be the bipartisan Congressional Gaming Caucus co-chairs. The brand new American Gambling Organization (AGA), the brand new tribal gaming community, or any other stakeholders support which change. To date, there has been no voice opposition on the advised alter. On may 5, 2024, they reintroduced the brand new legislation in order to update the brand new Position Operate and you can amend the new fifty-year-old, dated reporting endurance.

Cybersecurity to possess Tax Analysis: Safeguarding Organization Painful and sensitive Suggestions

One to jackpot will be about three unmarried bars to your a $one hundred minimal slot games. In any case, the new restriction to the digital keno is actually noted from the $1500, whether or not we have seen gambling enterprises which go to come and you may file the newest expected Mode W2-Grams at the $1200 on the keno too. Antonio, a member-time football gambler, is actually elated when their meticulously placed wagers on the basketball matches yielded a great $10,100000 funds in one year. By the devoting a number of vacations so you can throwing their receipts, speak logs, and you can account statements, Antonio gathered a clear comprehension of their earnings.

Taxes to your Betting Payouts and you can Losses: 8 Tips to Think about

As it really does to have property-based bettors, a comparable pertains to on-line casino participants. Taxation for the playing payouts is actually payable whether or not you bet on the web otherwise with a merchandising sportsbook. While the prices and you will legislation to own government income tax would be the same, there can be differences in the state income tax cost to own each other kinds of sports betting. Playing earnings is practically always nonexempt earnings which is said for the the taxation come back because the Other Money for the Agenda 1 – eFileIT.

You are doing get to subtract half of oneself-employment income tax since the a modifications to help you money on line 30 out of Mode 1040. For many gamblers, it’s lower (to own taxation) becoming a beginner than just a professional. Talk to an expert income tax mentor before you make the choice to end up being an expert gambler. You to significant disadvantage away from revealing online gaming money to the a routine C form ‘s the earnings is subject to thinking-work taxation (as well as regular income taxes).

Your online gambling enterprise need matter an excellent W-2G function should you get gambling winnings otherwise have any earnings susceptible to federal taxation withholding. Sure, as well as during the casinos on the internet otherwise on the internet gaming sites. Gambling payouts are taxable in every says of your own Us from America regarding government taxation. Like all other taxable earnings, the fresh Internal revenue service requires one to declaration honors and you can winnings on your own taxation come back, as well. Meaning you might have to shell out taxation on the the individuals winnings. Their winnings getting used in your nonexempt income, which is used to estimate the newest income tax your debt.

Government Unemployment Income tax Management 101: FUTA Strategies for Companies

Since you may assume, the newest says would also like their share of one’s income tax. If you live in a state where football bettors must pay taxation on the winnings, the state have a tendency to assume one to tend to be the payouts as part of your own income on their state productivity. Thanks to the repeal of one’s Elite and you can Beginner Sports Defense Act (PASPA) inside the 2018, we’ve 39 states and you can areas that have legalized sports betting. It’s already been a victory-win state both for people and you may condition governments. The former is bet instead of points, while the second provides more chances to grow funds thanks to taxable winnings. The brand new federal tax rate to your earnings is actually a flat percentage for everybody claims in which sports betting are judge.

Explain Investment Money and Projected Income tax Costs inside the 2025

You will also you want files such as wager glides, tickets, receipts, and you can financial comments. Should your operator awarded Function W-2 Grams and you may Setting 5754, you need to have them safer. As an example, they doesn’t matter if your profits come from Colorado or Virginia, Alabama tend to anticipate you to definitely spend the money for county tax if it’s your property county.

Ultimate Judge gave states permission to legalize wagering once they wished to do it. It’s legal within the 38 says and also the Region from Columbia, as of 2024. Casinos aren’t necessary to withhold fees otherwise issue an excellent W2-Grams to professionals which victory huge amounts in the certain desk game, for example blackjack, craps, and you will roulette. Cellular gambling enterprise payouts – Some thing of one’s above online game using an android casino or ios local casino.

Care for logs of your betting points, such as the day, sort of games, numbers wagered, winnings, and you can loss. Facts range from lender comments, seats, and you can digital screenshots. This info are indispensable within the substantiating says should your Irs demands files. Non-cash honours, such as auto otherwise vacation, also are taxable, making use of their reasonable market value handled because the income. For instance, a $ten,000 web based poker earn or a good $2,one hundred thousand sports betting profit should be stated on your income tax return, regardless of whether the brand new winnings are paid in cash otherwise bonuses.